In a recent blog post, we highlighted the role that business-to-business (B2B) bitcoin payments have played in the growth of our transaction volume in the past year. In 2015, B2B payments made up over 10% of our transactions. The average B2B payment was around $2,500, which was significantly higher than the $100 average consumer payment.

We have recently made some enhancements to our Email Billing tool that make it even easier to collect B2B payments. Here’s a short tutorial on how businesses can use bitcoin and BitPay to solve some of the problems of international receivables.

Why Bitcoin Makes Sense for B2B Billing

Whether you're a freelance designer, law firm or international corporation, invoicing clients is a part of the everyday operations of your business. But if your business deals with international clients, receiving payments from other countries can be a pain.

Cross-border B2B payments are typically handled by bank wires, which (in the age of the Internet) are very slow, costly, and unnecessarily complicated. The procedure to figure out how a payor gets their bank to send money to your bank, and correctly to you, is rather cumbersome.

To check the status of a payment, the receiver logs into their bank and sees a transaction “INCOMING WIRE” with an amount that is nearly always less than what was expected. The bank offers little to no explanation regarding the path and fees that occurred along the way.

Because bitcoin payments can be sent directly via the Internet in transactions that take minutes to confirm, they are ideally suited for sending money across long distances faster and more affordably than traditional methods. Plus, payments arrive for the exact amount requested, with full visibility.

A wide variety of businesses have already started to take advantage of billing with bitcoin, including media sites selling advertising, IT services firms, and legal and accounting services groups. As we highlighted in our previous post on bitcoin billing, it helped DDOS mitigator Nexusguard deliver immediate assistance to an international client – something not possible with bank transfers today.

How Bitcoin Billing Works

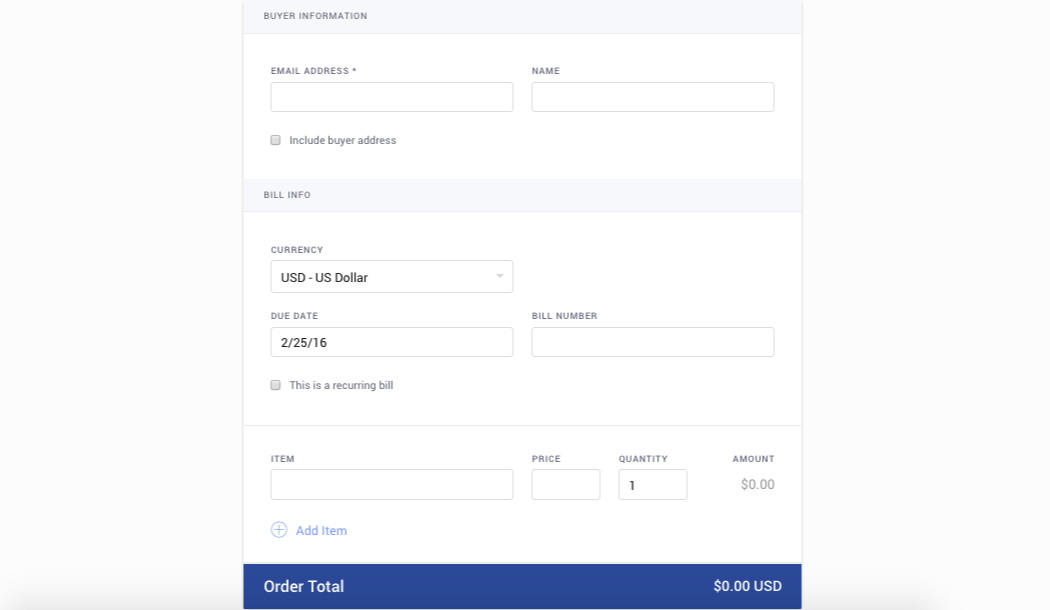

The BitPay billing tool has been the primary way that our merchants have taken advantage of this feature of bitcoin. It allows businesses to send itemized payment requests via email. For businesses accepting recurring payments, those bills can be configured to send repeatedly on weekly, monthly, quarterly, or yearly schedules.

To access the Billing tool, visit Payment Tools -> Email Billing in your BitPay account.

When you create and send a bill, your clients will receive an email from BitPay which they can open to view bill details. When they are ready to pay, they can choose to pay via bitcoin from any bitcoin wallet at any time. You can keep track of your outstanding bills in your merchant dashboard, and the transaction details for all bills are recorded in your BitPay dashboard's searchable Payments View feature.

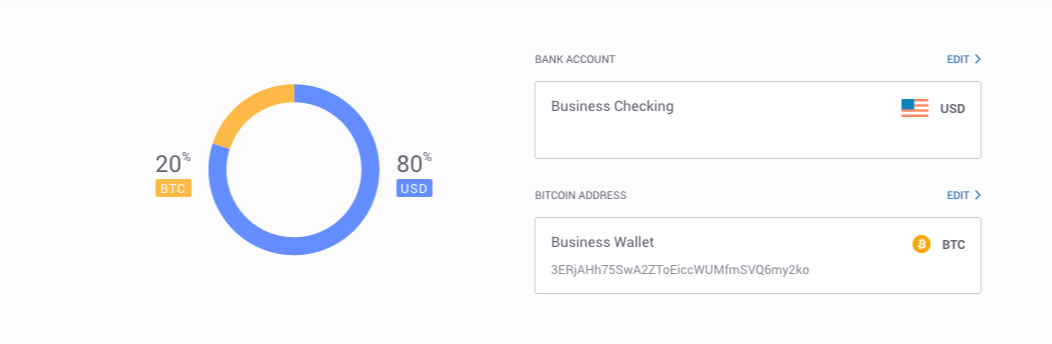

Payments received are settled the next day from BitPay to you, to the bank account or bitcoin wallet you have configured in your BitPay dashboard.

Getting Started

If you would like to offer your clients the ability to pay with bitcoin, it's easy to get started. Let your clients know that they will receive their next bills via email from BitPay, and share our guide to paying a BitPay invoice. If your clients need to purchase bitcoin to pay their bills, they can use any of the popular bitcoin exchanges to trade USD, EUR, or other local currencies for BTC.

If you want to test this feature first, you can follow our guide to creating and using a test.bitpay.com account. And finally, if you have any feedback on this new feature, let us know through the email icon in your BitPay merchant dashboard.